how much tax is taken out of my first paycheck

For Tax Years 2017 and 2018 the North Carolina individual income tax rate is 5499 005499. These include Roth 401k contributions.

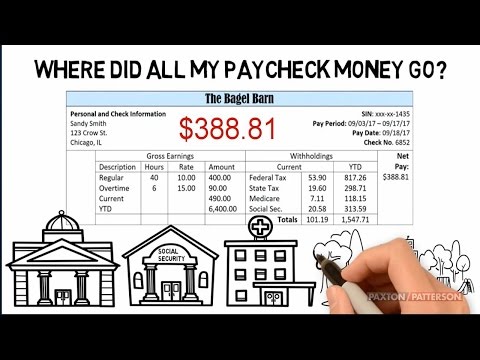

How To Understand Your Paycheck Youtube

Web Why does my W-2 show no federal tax withheld.

. For Medicare you will owe 09 of your gross wages. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. You pay the tax on only the first 147000 of your earnings in 2022.

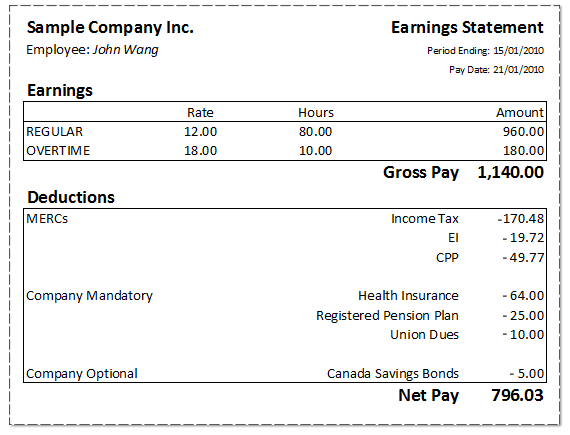

Import Payroll Runs To Be Automatically Categorized As Expenses. Web First she will automatically receive a standard deduction 5950 for tax year 2012 and possibly other tax credits when she completes her tax return. The maximum limit for the Social Security tax is 7886 a year for an individual earning more than 127200 per year.

Too little could mean an unexpected tax bill or penalty. 915 on portion of taxable income over 44470 up -to 89482. Your employer pays an equivalent share for a total 153.

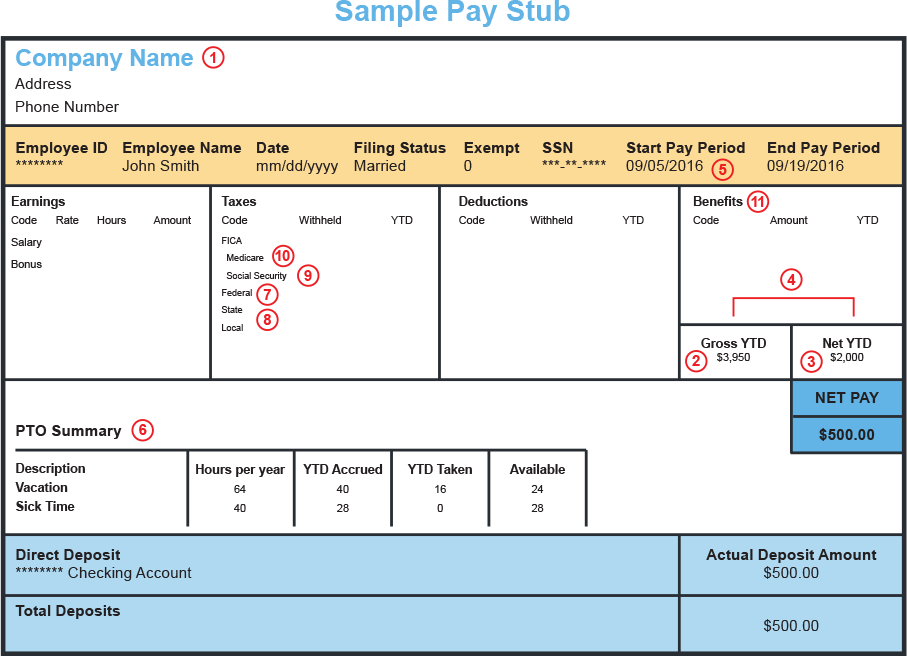

Most recent pay stubs most recent income tax return Use our Tax Withholding Estimator You should check your withholding if you. Web The money also grows tax-free so that you only pay income tax when you withdraw it at which point it has hopefully grown substantially. Web Federal income taxes are paid in tiers.

Web For Tax Years 2019 and 2020 the North Carolina individual income tax rate is 525 00525. Some deductions from your paycheck are made post-tax. Web How much tax is taken off a paycheck in Ontario.

Line 7 of your W-4 form allows you to file exempt by writing EXEMPT in the space provided. Web A Paycheck Checkup can help you see if youre withholding the right amount of tax from your paycheck. Ad Complete IRS Tax Forms Online or Print Government Tax Documents.

1116 on portion of taxable income over 89482 up-to 150000. The money for these accounts comes out of your wages after income tax has already been applied. For example for the 2012 tax year single filers paid a 10 percent federal income tax on the first 8700 of taxable income.

If your monthly paycheck is 6000 372 goes to Social Security and 87 goes to Medicare leaving you with 6000 372 87 5541 Social Security Medicare Income tax brackets Every year IRS adjusts some tax provisions for inflation. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. Web The employer portion is 15 percent and the employee share is six percent.

Pretax items like health-care premiums. Your bracket depends on your taxable income and filing status. Filing Exempt One reason why no federal taxes were taken from your W2 is due to the details you listed on your W-4.

Web Use this tool to. Ad Try the Online Payroll Software That Saves You Time and Easy To Track Every Payday. These are the rates for taxes due.

See how your refund take-home pay or tax due are affected by withholding amount. What percentage of tax is taken out of my paycheck in Colorado. Learn More at AARP.

For Tax Years 2015 and 2016 the North Carolina individual income tax rate is 575 00575. If you chose to file exempt no federal income tax will be taken out of your Leave and. 10 12 22 24 32 35 and 37.

The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. 505 on the first 44470 of taxable income. Web From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches.

For Medicare taxes 145 is deducted from each paycheck and your employer matches that amount. Choose an estimated withholding amount that works for you. Web How Your New Jersey Paycheck Works.

Your employer uses the information that you provided on your W-4 form to determine how much to withhold in federal income tax each pay period. 6 Often Overlooked Tax Breaks You Dont Want to Miss. Results are as accurate as the information you enter.

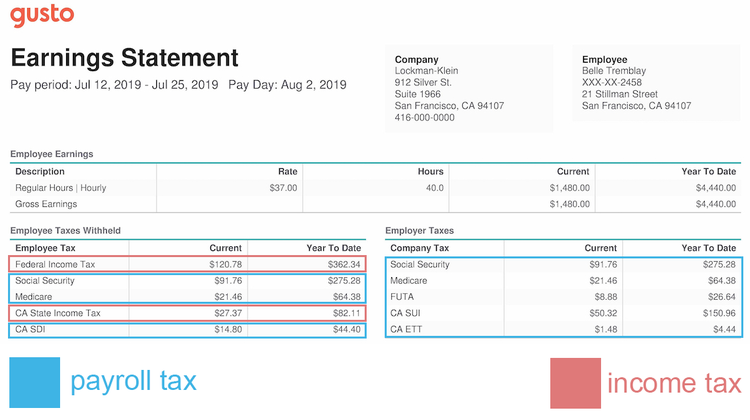

The current rate for Medicare is 145 for the employer and 145 for the employee or 29 total. We have a progressive income tax structure in the US. Federal income taxes are also withheld from each of your paychecks.

Use Our Free Powerful Software to Estimate Your Taxes. Any income exceeding that amount will not be taxed. Web Youll see 62 withheld from your paycheck for Social Security plus another 145 for Medicare.

Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. See What Credits and Deductions Apply to You. Only the very.

Several factors - like your marital status salary and additional tax withholdings - play a role in how much is. Web For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. Web There are seven federal tax brackets for the 2021 tax year.

Estimate your federal income tax withholding. For a single filer the first 9875 you earn is taxed at 10. Ad Enter Your Tax Information.

Combined the FICA tax rate is 153 of the employees wages. You will owe the rest of the tax which is 153 percent. Web What percentage of taxes are taken out of payroll.

You will need your.

Free Online Paycheck Calculator Calculate Take Home Pay 2022

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Why Did My Federal Withholding Go Up

Is Federal Tax Not Withheld If A Paycheck Is Too Small Quora

Understanding Your Paycheck Youtube

Understanding Pre And Post Tax Deductions On Your Paycheck Gobankingrates

Understanding Your Paycheck Credit Com

Budget Printable Editable Paycheck Budgeting Personal Etsy Paycheck Budget Budgeting Budget Printables

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Understanding What S On Your Paycheck Xcelhr

Do You Know What S Being Deducted From Your Paycheck Gobankingrates

Do You Know What S Being Deducted From Your Paycheck Gobankingrates

Paycheck Taxes Federal State Local Withholding H R Block

Paycheck Calculator Online For Per Pay Period Create W 4

Payroll Tax Vs Income Tax What S The Difference

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto